(Money, taxation) Tax deductions from registered "cash card" transactions

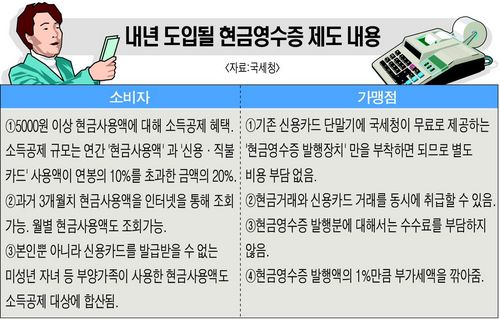

Chosun Ilbo reports that a certain amount of cash purchases through "cash receipt" system can be deducted in taxes, beginning next year. To put it simply, the authorities want to have more purchases registered and more business income under taxation, and are planning to use these tax incentives for private persons to promote it. Business keepers can have the registration machine, connectable to a creedit card machine, free from the Tax Administration. The cash purchase can be registered using a credit card, cash card (hyôn'gûm chibul k'adû), membership card or a like, and the purchase gets registered in the Tax Office (Kuksech'ông). Tax deduction: 20% of the total amount of registered cash and credit purchases, which exceeds the 1/10 of one's yearly income can be deducted. (I'm pretty sure I got this wrong, so let's try it this way: henkilö voi vähentää 20% vuositulojen kymmenesosan ylittävästä rekisteröityjen käteis- ja korttiostosten summasta.) Someone has a yearly income of 50 mil. W, and has registered credit, bank, and cash card purchases of 25 million. This exceeds the 10% of his yearly income by 20 mil. W, of which he can deduce 20%, that is 4 million won. 직장인 A씨의 연봉이 5000만원이라고 치자. A씨가 1년간 사용한 ‘신용·직불카드 사용액’은 1500만원이고, 국세청에 통보된 현금사용액은 1000만원일 때 얼마나 소득공제를 받을까. 카드 사용액과 현금 사용액을 합친 2500만원(1500만+1000만)이 A씨 연봉의 10%(500만원)을 초과한 금액(2000만원)의 20%만큼인 400만원을 소득공제받을 수 있다.What does the shop get then? Reduction of the value added tax worth 1% of the registered cash purchases (현금영수증 발행액의 1%만큼 부가세를 면제). To me it seems that the government is really desperate to get money transfers and purchases registered and more income taxed to implement a system which sounds as complicated as this. I'm really sceptical of people's willingness to have their money transfers this closely watched, knowing the general suspicousness towards the government reaching for people's (Koreans') pockets (I'm not saying this is a natural human characteristic, because there are nations with people willing to trust the government with their tax money), and even more sceptical of shopkeepers' willingness to have all the transactions connected to the Tax office. Categories at del.icio.us/hunjang: businesskeepersㆍKoreaneconomyㆍmoney |

Comments to note "(Money, taxation) Tax deductions from registered "cash card" transactions" (Comments to posts older than 14 days are moderated)

Write a Comment